|

|

|

|---|

|

|

|

|---|

|

|

|---|---|

|

|

|

|

|

|

|

|---|

Check My Score: Understanding Credit Ratings and Reports

Managing your credit score is an essential part of maintaining financial health. The phrase 'check my score' encompasses not only the act of viewing your credit score but also understanding what it means and how it impacts your financial future.

Why Knowing Your Credit Score Matters

Your credit score is a numerical representation of your creditworthiness. Lenders use it to determine your eligibility for loans, credit cards, and other financial products.

Impact on Loan Eligibility

A higher credit score can make you eligible for better loan terms and lower interest rates.

Influence on Rental Applications

Landlords often check credit scores to assess rental applications, so a good score can be beneficial when seeking a new home.

How to Check Your Credit Score

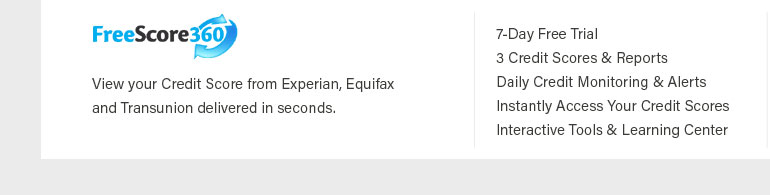

There are various services that allow you to check your credit score. These services can provide insights from major credit bureaus such as Experian, Equifax, and TransUnion.

For a comprehensive understanding, consider accessing experian all three credit reports to view detailed information from each bureau.

Pros and Cons of Checking Your Credit Score Regularly

Pros

- Awareness: Regular checks help you stay informed about your financial status.

- Error Detection: Identifying mistakes in your credit report early can prevent future issues.

Cons

- Anxiety: Frequent checking might cause unnecessary stress if scores fluctuate.

- Potential Costs: Some services charge fees, so it's important to choose wisely.

FAQ: Frequently Asked Questions

How often should I check my credit score?

It's advisable to check your score at least once a year to ensure accuracy and monitor your financial health.

Will checking my credit score lower it?

No, checking your own credit score is considered a soft inquiry and does not impact your score.

What factors affect my credit score the most?

Payment history, credit utilization, length of credit history, new credit inquiries, and types of credit accounts are key factors.

Using Multiple Credit Reporting Services

To get a well-rounded view of your credit, it's beneficial to consider both experian and transunion credit score reports, as each may have slightly different information.

Understanding your credit score and report can empower you to make informed financial decisions. Regular monitoring can help maintain your financial health and prepare you for future opportunities.

Checking your credit score: If you are personally checking your credit score, your credit score will not go down. It's only when someone else runs a hard credit ...

Online by visiting AnnualCreditReport.com - By calling 1-877-322-8228 (TTY: 1-800-821-7232) - By filling out the Annual Credit Report request form ...

Yes, you can access your free credit report on your CreditView Dashboard. With the mobile app: Choose Help & services from the main menu, and then scroll to ...

![]()